CMS’s January 2026 payment proposal targets chart review practices that generated $24 billion in Medicare overpayments, forcing MA plans to compete on outcomes instead of coding sophistication. 2027 Medicare Advantage and Part D Advance Notice

Medicare Advantage just had its worst week in a decade. On January 26, 2026, CMS dropped a payment proposal that wiped out $80 billion in market value overnight. The damage came from two sources: a nearly flat rate increase of just 0.09% and a controversial crackdown on “chart review” billing practices that CMS says have drained $24 billion from Medicare. For the 35 million Americans enrolled in Medicare Advantage (now 51% of all Medicare beneficiaries), these changes could reshape everything from plan availability to the benefits they receive.

The Two Bombshells – 2027 Medicare Advantage

The headline number is brutal enough. CMS proposed just a 0.09% payment increase for 2027, adding only $700 million to plan payments. That’s a 98% drop from this year’s 5.06% bump that added $25 billion. And it’s well below the 4.5% medical cost inflation rate, meaning plans will lose money on every patient just from rising healthcare costs.

But the second change cuts deeper.

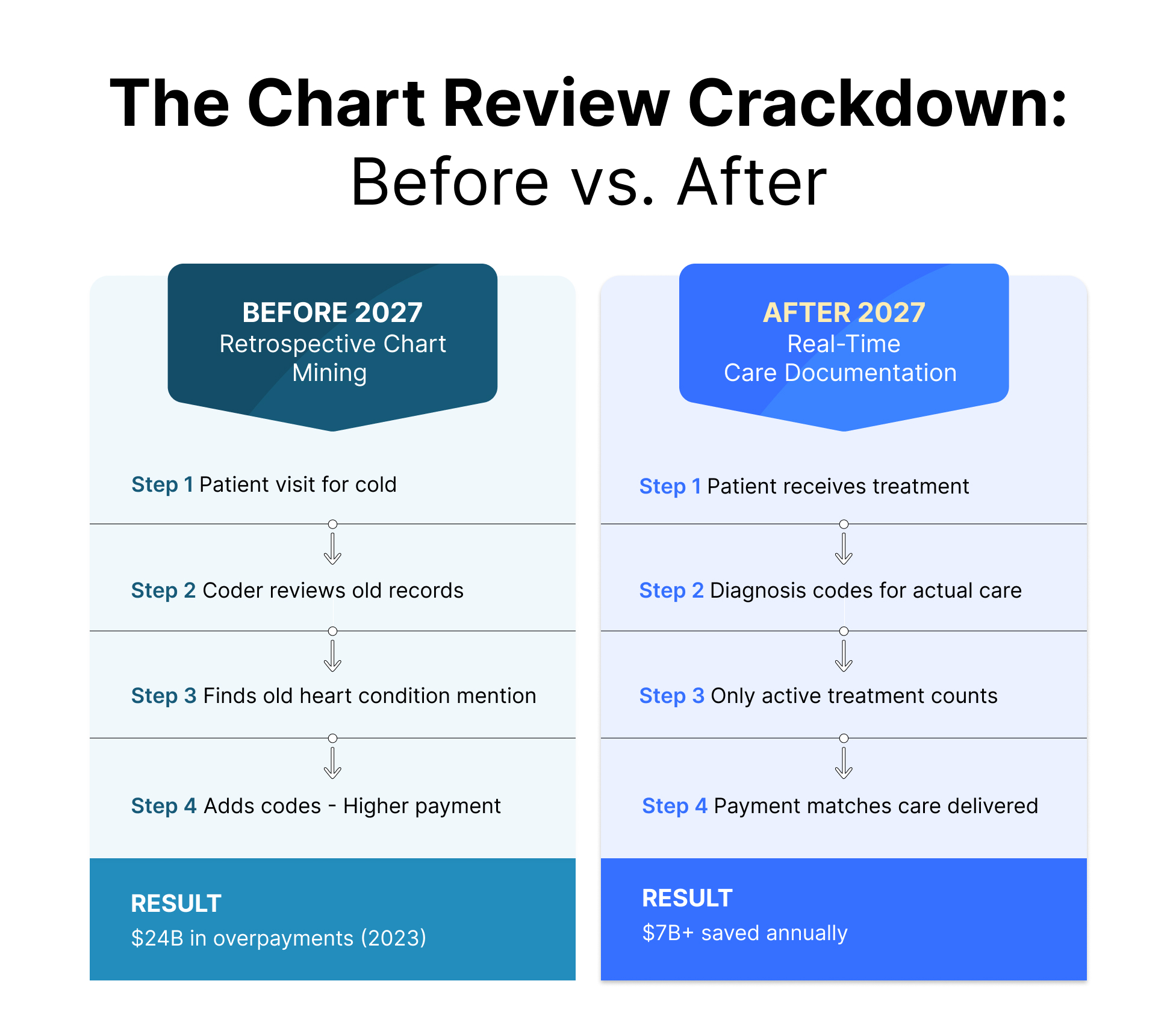

CMS plans to exclude two diagnosis sources from risk adjustment calculations starting in 2027: unlinked chart reviews and audio-only telehealth visits. These are diagnoses that don’t connect to actual medical encounters where patients received treatment.

Here’s how the most problematic practice worked. For years, Medicare Advantage plans realized they could boost their government payments by hiring coders to dig through old medical records. A patient visits the doctor for a cold. Six months later, the plan reviews that old chart and finds a mention of a possible heart condition from years ago. They add that diagnosis code to boost their risk score, which increases their payment from Medicare. The patient never received treatment for that condition during the visit.

CMS calls these “unlinked chart reviews” because the diagnoses aren’t connected to actual medical encounters. Starting in 2027, those codes won’t count anymore. Audio-only telehealth visits that captured diagnoses without physical examinations face the same fate. This single

change cuts payment rates by another 1.53 percentage points and saves Medicare more than $7 billion each year.

CMS calls these “unlinked chart reviews” because the diagnoses aren’t connected to actual medical encounters. Starting in 2027, those codes won’t count anymore. This single change cuts payment rates by another 1.53 percentage points and saves Medicare more than $7 billion each year.

The numbers reveal how widespread this became. In 2022, one out of every six MA enrollees had a chart review that increased their plan’s reimbursement. MedPAC, which advises Congress on Medicare, estimates these reviews generated $24 billion in overpayments during 2023 alone.

How the Industry is Reacting

The insurance lobby, AHIP, immediately warned that flat funding “could result in benefit cuts and higher costs for 35 million seniors.” Major insurer stocks dropped between 12% and 20% in a single day. Several plans are already threatening to exit certain markets or reduce profits if these rates hold. CMS leadership is standing firm.

Chris Klomp, the Medicare Director, put it bluntly: “We don’t want risk adjustment to be a source of competitive advantage for health plans. That’s instead of an arms race based on who can game the system better.” But he also stressed that “we are MASSIVELY in support of Medicare Advantage.” The message is clear: gaming stops, but the program continues. Physicians are less sympathetic to plan complaints.

The AMA pointed out a glaring disparity. MA plans received a 5.06% increase for 2026 while physicians are facing their fifth consecutive year of payment cuts (2.8% this time). As the AMA stated: “It’s unbelievable they’re giving insurance companies record profits an increase while cutting payment to physician practices struggling to survive.”

Providers have mixed feelings. Many welcome reliefs from the excessive documentation burden that chart review practices created. But they also worry that financially stressed plans will respond by cutting provider reimbursement rates or narrowing their networks.

Who Wins and Who Loses?

Not every plan faces the same level of risk here.

The losers are plans that built their business models around aggressive chart reviews. These organizations invested heavily in coding departments focused on mining historical medical records. They have large operations dedicated to retrospective documentation but less sophisticated tools for managing patient health in real time. These plans face immediate revenue hits when 2027 starts and will need to make hard choices about benefits, premiums, and which markets they can afford to serve.

The winners are plans that saw this coming and changed course early. They reduced their dependence on chart reviews and put resources into real-time care management instead. They built technology platforms that use analytics to identify patients who need intervention before they end up in the hospital. They created strong partnerships with providers based on improving outcomes, not just optimizing codes.

This creates opportunities too. Regional plans with cleaner coding practices might gain market share if larger national plans exit certain areas. Plans with high Star Ratings will benefit because quality-based payments become more important when volume-based coding advantages disappear. Technology vendors that offer legitimate care coordination tools (rather than chart review services) should see increased demand.

The fundamental competitive dynamic is shifting. For the past decade, success in Medicare Advantage often depended on who could extract the most diagnosis codes from historical charts. Going forward, success will depend on who can deliver the best health outcomes through proactive population health management.

Where Technology Meets Reality

The shift CMS is forcing requires different capabilities than most plans built over the past decade. Organizations need platforms that can identify high-risk patients before they require expensive interventions, coordinate care across multiple providers, and track outcomes in ways that demonstrate actual value rather than coding sophistication.

Persivia’s CareSpace® platform addresses these requirements through integrated population health management. The system aggregates EHR, clinical, labs, device, SDoH and claims data to create a complete picture of each patient’s health status and care gaps. Rather than looking backward through historical charts, it analyzes current data to predict which patients need outreach. Care managers get prioritized work lists based on risk stratification algorithms that identify who’s most likely to experience complications or avoidable hospitalizations.

The platform handles quality measure tracking for programs like MSSP and value-based contracts, which become more critical when pure volume-based reimbursement decreases. It also automates Star Ratings reporting, helping plans maintain the quality scores that matter more for their financial performance. Built-in care coordination tools let teams manage chronic conditions proactively instead of documenting them retrospectively.

For organizations navigating this transition, these capabilities represent the difference between adapting successfully and struggling with a business model that no longer works. Technology exists to compete on outcomes rather than coding. The question is whether plans will invest in it quickly enough.

What Happens Next

The comment period runs through February 25, 2026, giving the industry one last chance to lobby for changes. CMS will release its final rate announcement by April 6. Historically, the agency makes some upward revisions between the advance notice and the final rule, but their messaging suggests they’ll hold firm on eliminating chart reviews.

Plans must submit their 2027 bids by June 2, forcing critical decisions about markets, benefits, and pricing. Open enrollment runs from October 15 to December 7, when beneficiaries will discover how these changes affected their coverage options.

Conclusion

This goes beyond routine rate adjustment. CMS is resetting how Medicare Advantage works. The “golden era” when plans could reliably grow revenue through coding optimization is finished. The question now is whether plans can successfully pivot from gaming the payment system to genuinely managing population health.

The April 6 final rule will show us if this becomes a course correction that strengthens Medicare Advantage by forcing competition on value, or if it triggers instability that hurts the 35 million people who depend on these plans. Either way, the healthcare industry is about to look different than it has for the past decade.

Frequently Asked Questions

What are unlinked chart reviews in Medicare Advantage?

Retrospective reviews of old medical records to find diagnosis codes that aren’t connected to actual patient treatment. Plans use them to artificially increase their risk scores and receive higher payments from Medicare.

How much will Medicare Advantage rates increase in 2027?

CMS proposed only 0.09%, which is essentially flat. This equals roughly $700 million compared to 2026’s $25 billion increase. The final rate will be announced by April 6, 2026.

How much money does chart review elimination save Medicare?

CMS estimates over $7 billion in savings for 2027 alone. The Medicare Payment Advisory Commission found that chart reviews drove $24 billion in overpayments during 2023.

Will my Medicare Advantage benefits be cut?

Possibly. Insurance industry groups warn that flat funding could force benefit reductions, premium increases, or cause plans to exit certain geographic markets. Check your plan’s Annual Notice of Change for specifics.

When does the chart review policy take effect?

January 1, 2027, if the proposal is finalized as written. The final decision comes on or before April 6, 2026, after the public comment period closes February 25.

Who is most affected by these Medicare Advantage changes?

Plans that relied heavily on retrospective chart reviews face the biggest financial impact. Plans that are already invested in care management technology and reduced chart review dependence may gain competitive advantages.

See how real-time analytics replace retrospective chart reviews. Request a CareSpace® demo to learn how leading MA organizations are preparing for 2027.

Table of Contents