Preventable complications cost healthcare organizations millions each year. For instance, a diabetic patient misses critical follow-up care. Hospital readmission rates increase exponentially because discharge instructions often fail to reach the primary care team. Or, administrative staff manually process claims for hours when software could finish the work in seconds. A Value-based care platform fixes such concerns by connecting fragmented data sources, flagging at-risk patients before crises develop, and automating workflows that consume clinical time.

More than 50% of U.S. healthcare payments now depend on VBC models. In 2024, 92% of payers and 81% of providers reported contract growth. After seeing further significant numbers in 2025, organizations expect revenue to shift toward VBC in 2026, too. Quality metrics now control reimbursements, and organizations lacking proper technology infrastructure will see revenue decline. Platform selection directly determines financial outcomes under value-based contracts.

What is a Value-Based Care Platform?

Value-based care platforms link clinical data, claims, and workflows to tie provider payments to patient outcomes rather than service volume. These platforms handle three major tasks:

- Workflow Automation: Creates care plans, assigns tasks, launches outreach campaigns, and tracks quality metrics automatically

2. Data Aggregation: The VBC software creates a unified patient record by pulling information from:

- EHRs

- Claims systems

- Health information exchanges

- Labs

- Pharmacies

- Social Determinants of Health (SDoH) into unified patient records

3. Predictive Analytics: Flags patients at high risk for hospitalization or disease progression before emergencies develop

4. Workflow Automation: Creates care plans, assigns tasks, launches outreach campaigns, and tracks quality metrics automatically

Did You Know?

High-performing value-based care models achieve 7.8% savings per beneficiary and 5% overall care cost reductions compared to traditional reimbursement structures.

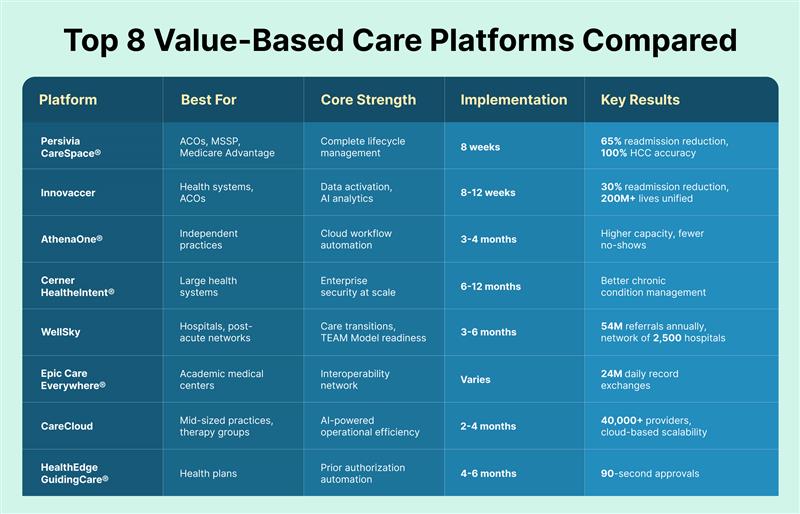

Top 8 Value -Based Care Software Compared

The following comparison highlights leading Value-Based Care software providers based on clinical capabilities, implementation speed, and performance under value-based contracts.

1. Persivia CareSpace®: Complete Value-Based Care Solution

Persivia CareSpace® manages the entire care lifecycle from risk stratification through point-of-care intervention and analytics. Unlike competitors that treat advanced analytics as optional features, CareSpace® builds intelligent automation into its foundation.

The Soliton® Analytics Engine – Top Notch Value-Based Care Platform

The proprietary Soliton® engine delivers three integrated capabilities:

1.Predictive Analytics

The platform examines over 1,600 data points per patient to forecast hospitalization risks, ED visits, and disease progression. It achieves 90% accuracy in identifying high-cost patients.

2. Prescriptive Recommendations

It provides specific clinical actions based on evidence-based protocols tailored to each patient. Also, care managers receive prioritized work lists with intervention suggestions rather than raw data requiring interpretation.

3. Automated Documentation

CareSpace® generates patient communications, clinical assessments, and standard forms. This extracts hierarchical condition category codes from physician notes with 98% accuracy.

Note: Organizations report 85% efficiency gains through automated risk stratification versus manual chart reviews.

CareTrak®: Where Clinicians Work

Clinicians rarely review separate applications during patient encounters, despite the available insights. CareTrak® solves this by embedding intelligence directly into EHR workflows through bi-directional connections with Epic, Cerner, Athena, NextGen, eClinicalWorks, and over 60 other systems.

Real-time clinician view:

- Automatic data updates are written back to the source EHRs

- Care gap alerts within EHR screens

- Medication interaction warnings during prescribing

- Risk-based intervention recommendations

CMS TEAM Model Readiness

The CMS TEAM Model introduces mandatory episode-based accountability for hospitals beginning in 2026, with a strong focus on care transitions, post-acute utilization, and complication reduction.

Persivia CareSpace® supports TEAM Model participation by enabling real-time episode tracking, automated care transition workflows, post-discharge monitoring, and analytics that surface cost and quality drivers across the full episode window.

200+ Pre-Built Clinical Programs

CareSpace® includes over 200 evidence-based programs covering chronic disease management, care transitions, preventive care, behavioral health, and social determinants. Organizations deploy these Value-Based Care Software immediately or customize them for local practices and payer requirements.

This approach speeds up results. Programs go live within weeks, not months. Also, no building protocols from scratch.

Clinical Results

McLaren Physician Partners

Here, the VBC platform reduced ED overutilization within six months while improving HEDIS quality scores. The platform helped them reach 6th place nationally among Medicare Shared Savings Program ACOs, generating $34 million in shared savings.

HCA Florida Oak Hill Hospital

It achieved a 65% reduction in 30-day readmissions through automated care transition protocols.

Client-wide metrics:

- 100% improvement in RAF scores via enhanced HCC capture

- 120% increase in chronic condition coding accuracy

- 91% care gap closure rate across quality measures

- $17.89 PMPM (per member per month) in ACO savings versus average performance

Implementation Timeline

Persivia’s data pipeline becomes operational within 8 weeks. Most enterprise population health platforms require 6-12 months. The modular design permits organizations to begin with specific capabilities and expand as value-based contracts grow.

Current deployment:

- 200+ hospitals

- 12,000+ clinicians

- 160+ million patient records

Best For: ACOs in MSSP or ACO REACH programs, Medicare Advantage plans improving STAR ratings, integrated delivery networks with multiple value-based contracts, and health systems needing comprehensive population health management.

2. Innovaccer: Data Activation Platform for Health Systems

Innovaccer has emerged as a leading data activation platform serving six of the U.S.’s top 10 healthcare systems. The company recently raised $275 million in Series F funding at a $3.45 billion valuation, positioning it as an AI powerhouse in healthcare technology entering 2026.

Core capabilities include:

- Unified data infrastructure aggregating 200+ million lives

- AI-powered care management workflows and assistants

- Population health management applications

- CRM and patient engagement tools

- Contract and financial performance analytics

Implementation Profile

The platform typically deploys in 8-12 weeks, with data integration completed first, followed by workflow configuration and user training. Research shows that over 60% of health organizations expect higher VBC revenue in 2026, with capitated models doubling since 2021.

Best For: Large health systems requiring data activation across multiple EHRs, ACOs managing complex value-based contracts, organizations preparing for CMS TEAM Model participation, and payers seeking comprehensive population health analytics.

3. Athenahealth AthenaOne®: Cloud Platform for Independent Practices

AthenaOne® connects over 160,000 providers through cloud infrastructure focused on ambulatory care and revenue cycle management.

Core capabilities:

- Automated appointment scheduling, prescription refills, and patient inquiries

- Smart scheduling optimizes slots using provider availability, patient acuity, and no-show history

- Real-time eligibility verification prevents claim denials

- Integrated telehealth with scheduling, documentation, and billing

Limitation: Population health features lag purpose-built value-based care solutions. Organizations managing complex ACO contracts or multiple risk arrangements may find analytics and care coordination insufficient for advanced needs.

Best For: Independent primary care practices, urgent care centers, small physician groups, organizations prioritizing revenue cycle efficiency with basic care coordination.

4. Cerner HealtheIntent®: Enterprise Security and Scale

Oracle’s Cerner HealtheIntent® processes billions of clinical transactions monthly across integrated networks and large health systems.

Strengths:

- Quantum-resistant encryption against emerging cyber threats

- HIPAA-compliant blockchain for immutable audit trails

- Real-time anomaly detection for unusual access patterns

- Advanced algorithms generating care management risk scores

- CommunityWorks connects critical access hospitals with academic centers

Consideration: Implementation typically spans 6-12 months for full enterprise deployment. Substantial internal IT resources are required for continuous optimization.

Best For: Large integrated delivery networks, academic medical centers with complex referrals, Medicare Advantage plans needing enterprise security, and health systems with existing Cerner EHR investments.

5. WellSky: Post-Acute Care Coordination Network

WellSky operates as the “Switzerland of healthcare,” connecting providers across inpatient, post-acute, outpatient, and home health settings through one of the nation’s largest care transition networks.

AI-Based Key Features:

- AI-powered document summaries, scanning referral packets, and generating concise patient information within seconds

- Automated clinical documentation reduces provider burnout

- Documentation assistance across behavioral health, rehabilitation, and long-term acute care

- Predictive analytics identifying patient risks and optimizing discharge timing

Implementation Approach

The WellSky Value-Based Care Suite typically deploys in 3-6 months, with phased rollouts allowing organizations to start with discharge planning and expand to full care coordination capabilities. The platform includes both software solutions and clinical operations services, with on-site clinicians available to work alongside provider teams

Best For: Hospitals preparing for CMS TEAM Model requirements, ACOs managing post-acute care networks, health systems seeking to reduce network leakage, risk-bearing entities requiring care transitions visibility, and organizations bridging acute and post-acute data gaps.

6. Epic Care Everywhere®: Interoperability Network

Epic’s Care Everywhere network spans 2,700+ hospitals nationwide, exchanging 24 million patient records daily.

Advantages:

- Health information access for a substantial U.S. population

- Integration with Carequality and CommonWell Health Alliance beyond the Epic ecosystem

- MyChart patient portal with secure messaging, scheduling, and automated prior authorization

- Cosmos research database powering clinical studies

Limitation: Population health analytics and care coordination lag platforms purpose-built for value-based care. This solution requires significant customization for complex care management workflows and advanced predictive analytics.

Best For: Academic medical centers conducting research, large health systems requiring comprehensive external interoperability, and research hospitals using real-world evidence for treatment optimization.

7. CareCloud: AI-Powered Platform for Practice Efficiency

CareCloud serves more than 40,000 providers with cloud-based healthcare technology, emphasizing operational efficiency and practice management.

CareCloud’s integrated platform includes:

- EHR system with customizable clinical documentation templates

- Revenue cycle management (RCM) with CollectiveIQ billing rules engine

- Practice management and intelligent scheduling

- AI-powered clinical documentation and decision support

- Telehealth with generative AI capabilities

- Patient experience management (PXM) tools

- Business intelligence and analytics dashboards

Implementation and Pricing

CareCloud typically deploys in 2-4 months, with cloud-based architecture eliminating substantial IT infrastructure requirements. The platform offers scalability from small practices to large multi-specialty groups.

Best For: Mid-sized practices managing value-based contracts, therapy and specialty care providers, organizations prioritizing cloud-based scalability, practices seeking integrated EHR and RCM solutions, and providers wanting AI-enhanced workflow efficiency without enterprise complexity.

8. HealthEdge GuidingCare®: Payer-Focused Platform

HealthEdge serves health plans and insurance companies managing millions of members.

Key features:

- Automated prior authorization in under 90 seconds

- High auto-adjudication rates are reducing manual processing costs

- Provider network analytics to reduce out-of-network referrals

- Connections to thousands of community social service agencies

- Housing intervention programs are cutting ED visits by approximately 20%

Limitation: Provider-facing features are less developed than care delivery systems. Health systems needing comprehensive care coordination may find payer-centric design lacks clinical workflow support.

Best For: Health insurance companies with commercial, Medicare, or Medicaid members, managed care organizations, and integrated delivery networks operating health plans.

Value-Based Care Platform Selection Guide

The choice of VBC models determines whether organizations succeed under outcome-based payment or struggle with compliance penalties.

What To Focus On During Platform Evaluation

- Unified Platform vs. Multiple Point Solutions

Platforms that consolidate data, analytics, care coordination, and compliance reporting into one system eliminate the complexity and data gaps created by managing multiple vendors.

- Insights Within Existing Workflows

Choose platforms where predictive insights and recommended actions appear directly in clinician workflows rather than requiring separate logins to access dashboards.

- Documented Clinical Outcomes

Platform evaluations should include specific metrics such as readmission reduction percentages, quality measure improvement rates, RAF score increases, and verified shared savings results from existing clients.

- Implementation Timeline

Platforms operational in 8-12 weeks provide faster returns than solutions requiring 6-12 months before delivering measurable value.

- Purpose-Built for Value-Based Care

Purpose-built platforms consistently outperform generic tools offered by VBC companies that primarily focus on fee-for-service workflows.

Pro Tip: Organizations entering 2026 should prioritize platforms with proven CMS TEAM Model capabilities, as over 748 hospitals face mandatory participation beginning January 1, 2026.

Takeaway

The selection of a value-based care platform determines whether healthcare organizations thrive under outcome-based reimbursement or struggle with compliance penalties. The Value-Based Care solutions profiled here represent fundamentally different approaches to population health management, with 2026 marking a pivotal year as CMS TEAM Model requirements take effect and AI capabilities mature across the industry.

Organizations participating in multiple value-based contracts benefit from end-to-end platforms that unify data, analytics, care coordination, and compliance reporting. The intelligence-powered approach enables proactive intervention before problems develop rather than reactive responses after expensive complications occur.

Table of Contents